Inflation Holds at 4% in January While the UK Slips into a Recession

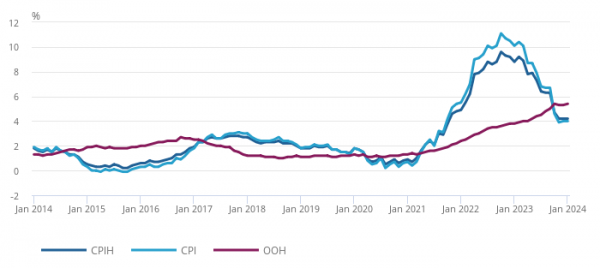

According to the most recent data released by the Office for National Statistics (ONS), the annual Consumer Price Index (CPI) inflation remained stable at 4% in January. Similarly, the CPIH inflation, which accounts for housing costs, also held at 4.2%.

On a monthly basis, there was a decrease of 0.6% in CPI and 0.4% in CPIH in January.

Source: ONS

Core CPI inflation, which excludes volatile factors such as food, energy, alcohol and tobacco prices held at 5.1% on a month-on-month basis.

The UK enters a recession

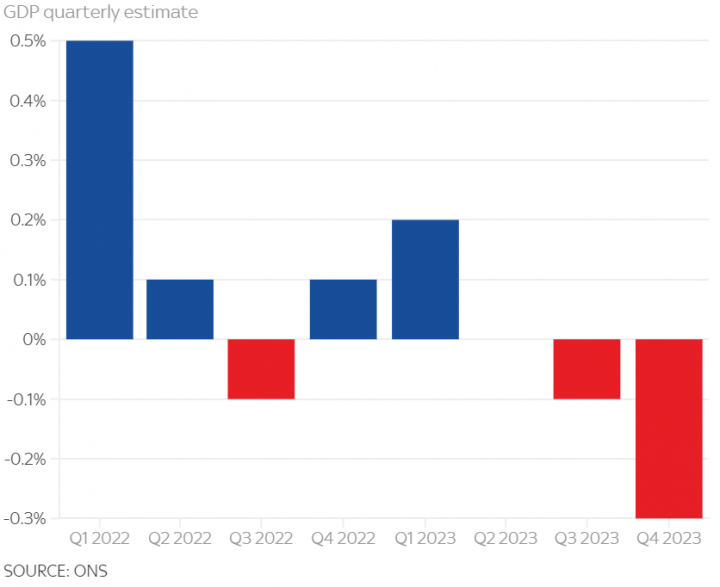

The United Kingdom officially entered a recession as gross domestic product (GDP) contracted by 0.3% in the fourth quarter of 2023, following a decline of 0.1% in the second quarter of the same year.

The decline in the last quarter was widespread across all three major sectors, with services output decreasing by 0.2%, production dropping by 1%, and construction decreasing by 1.3%. Overall, there was a marginal economic growth of 0.1% throughout 2023.

Although the UK's entry into recession after two consecutive quarters of economic contraction was anticipated, some economists classify it as a "technical" recession, expecting it to be short-lived as the country gradually recuperates through 2024. This recession was largely influenced due to the maintenance of high interest rates aimed at combating inflation.

Looking ahead

There are positive signs looking ahead The Chancellor, Jeremy Hunt, comments “But there are signs the British economy is turning a corner. Forecasters agree that growth will strengthen over the next few years, wages are rising faster than prices, mortgage rates are down, and unemployment remains low. Although times are still tough for many families, we must stick to the plan – cutting taxes on work and business to build a stronger economy.”

Inflation is projected to approach the target of 2% in April. Though the Bank of England is widely expected to reduce interest rates within the coming months, further pressure will be placed on the Bank to cut rates on the back of a recession.

What is the impact on the mortgage market?

With inflation holding at 4%, pressure on borrowing is still high, as seen by many lenders who have increased rates over the last couple of weeks. The announcement of the "technical recession," while anticipated, further underscores the challenges posed by high interest rates and the cost of living experienced in 2023. There is a prevailing consensus in the market that rates will begin to decrease later this year.

For personalised advice tailored to the current economic climate, consult with our experienced mortgage consultants or call 01628 564631. We're here to help navigate the impact of inflation and recession on mortgage rates, providing you with informed guidance every step of the way.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage.

Source: Office of National Statistics