Bank of England Vote to Hold Base Rate at 5.25% in February

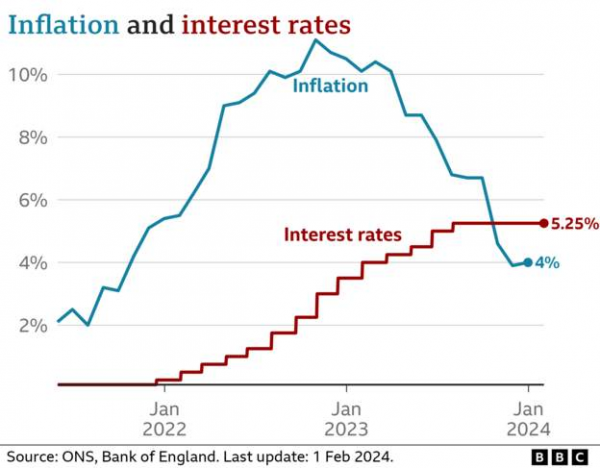

During the most recent meeting of the Monetary Policy Committee (MPC), the Bank of England has decided to maintain the Base Rate at 5.25% for the fourth consecutive month. This decision was reached with a majority vote of 6-3, marking the first three-way split on the vote since 2008. Specifically, six members favoured holding the Base Rate steady, while two members advocated for a 0.25% increase, and one member proposed a 0.25% decrease.

“Higher interest rates are working to reduce inflation”

Despite the anticipation of a potential Base Rate reduction in early 2024, the prevailing inflation figures have prompted a pause in such considerations. Governor Andrew Bailey emphasized the need for more convincing evidence that inflation will indeed subside to the 2% target and remain stable before contemplating any reduction in interest rates. In his words, “We need to see more evidence that inflation is set to fall all the way to the 2% target, and stay there, before we can lower interest rates.”

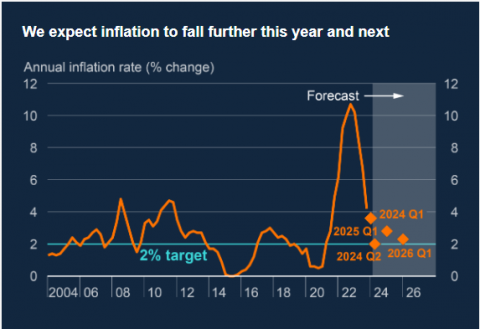

“Inflation could fall to our 2% target within a few months, before rising slightly again”

Since 2022, inflation has fallen from a peak of 11% to 4% in December 2023. Economists anticipate a temporary decline in inflation to the 2% target during the second quarter, followed by a slight increase due to costs of fuel. The Bank expect there to be a few bumps along the way but are projecting inflation figures to reach 2.75% by the close of the year.

“We will keep interest rates high for long enough, so inflation settles at 2%.”

Source: Bank of England

How does this affect the mortgage market?

Though there is still uncertainty in the short term, but the overall feeling is more confidence in the market as any further increases to the Base Rate are unlikely after four consecutive months of holding and focus moves onto when the Bank will lower interest rates.

With the split vote amongst the MPC, there is optimism that throughout 2024 there will be a gradual reduction in the Base Rate. Lenders will be keeping a close eye on how the Bank will react and with reductions they are expected to follow suit.

The beginning of the year has continued the trend started in late December with further reductions in rates improving affordability within the market. However, recent weeks have seen a difference in opinion between lenders continuing to reduce rates to entice new business and others being cautious, slightly increasing rates.

With uncertainty in the market, it is important to receive advice on securing the best mortgage for you. Contact us or call 01628 564631 for a consultation with one of our team members.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage.

Source: Bank of England