More Landlords are Planning to Switch to Limited Company Buy to Lets

According to a recent report from Paragon Bank, around a third of landlords with buy to let properties in their personal name are looking to incorporate a limited company within the next three years.

Paragon’s survey of over 1000 landlords, found that almost a quarter (23%) of landlords own all of their properties through a limited company, 31% have a mix of limited company and personal properties and 34% hold all of their properties in their personal name.

Paragon also found that 71% of these landlords’ first rental property was purchase in their personal name, indicating a clear shift in structure. Suggesting that landlords have favoured limited company option as their portfolios increased, either by incorporating or buying new properties through a limited company. For existing properties owned in personal names 33% of the landlords intend to incorporate within the next three years, while 37% said it was unlikely.

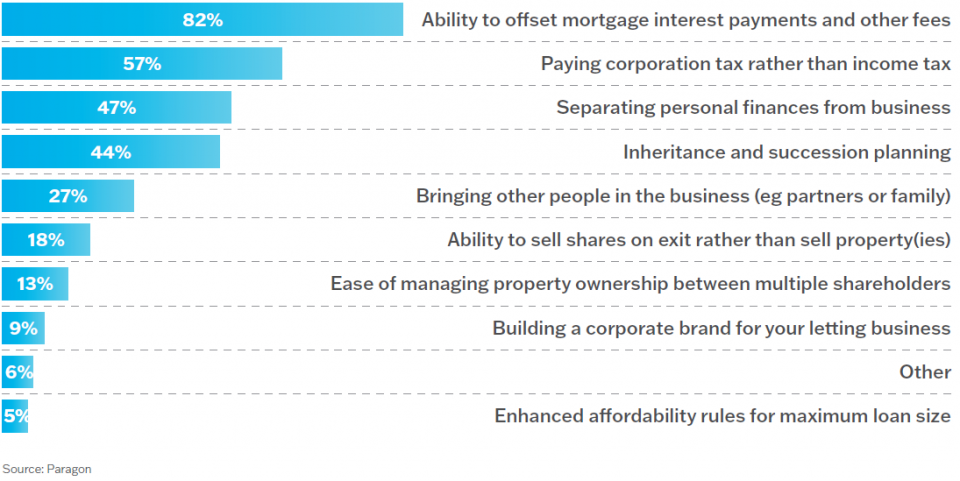

Incentives of Limited Companies

Taxes are a key driving reason for individual landlords to look towards a corporate structure. The ability to offset mortgage interest and other fees (mortgages fees) is seen as the main driver for 82% of landlords who choose to go opt for Limited company structure.

Through a limited company, taxes are calculated solely on net profits rather than gross income compared to individual landlords. Limited company structure has a great incentive for those on higher tax brackets (40%) and even more so for those on additional rate tax. For example, if a landlord were to generate £1500 on rent and pay £900 for a mortgage, the taxable amount would be £600, whereas in personal names tax would be paid on £1500 rent.

Limited company corporation tax, which is payable on net profits, is presently 19% on the first £50K of profits and 26.5% for the next £200k and 25% thereafter. Landlords also need to take into consideration extracting profits out of the company via dividends.

Inheritance Tax and succession planning are the other popular reasons landlords are considering Limited companies.

Landlords opting for the Limited Company route, or incorporating from their personal name, should consult specialist advisors to fully assess their tax implications for both options.

What are the key drivers for holding property within a Limited Company structure

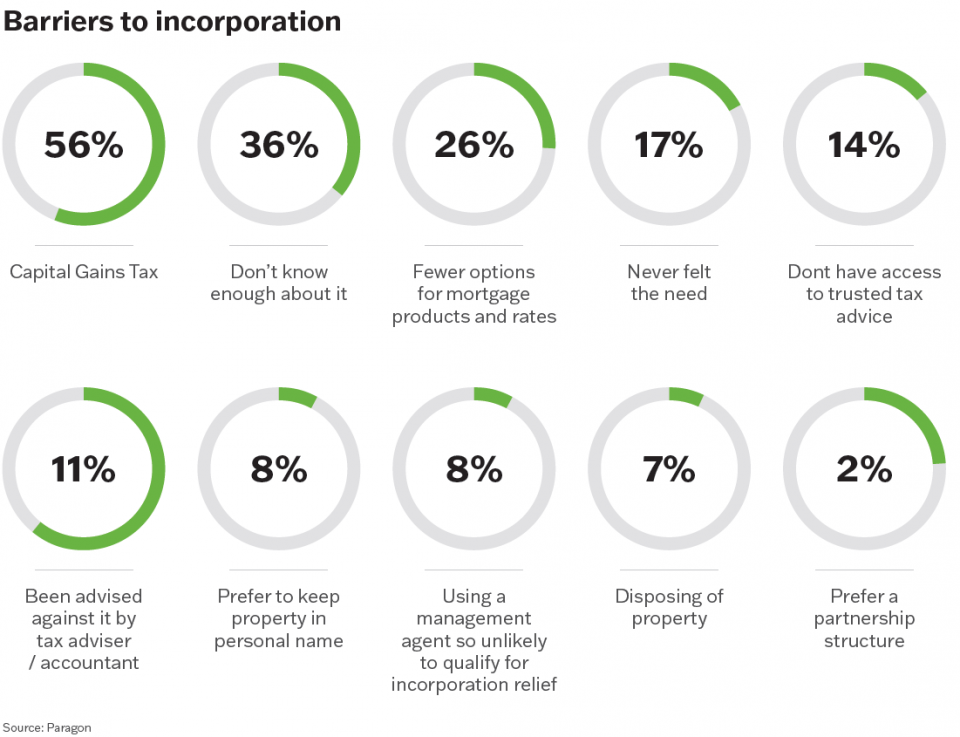

Barriers to incorporation

Along with many benefits to incorporating a limited company, there are barriers to consider. A big hurdle to overcome is Stamp Duty and Capital Gains Tax that must be paid when transferring existing properties into a limited company.

Furthermore, over a third of landlords did not have enough knowledge of the process, some did not feel the need and others were advised against it by their tax advisor or accountant.

In addition to the above, for many landlords, borrowing available in both structures is having an impact on direction taken.

Paragon tracked data over the years has highlighted:

- 76% of purchases in 2018 were via Limited structure and 91% this year

- Through Limited structure 16% of the mortgage transactions opted for 2 year fixed rates while in personal names 6%. It is strongly expected the reason for this is down to the rental calculations and the amount available due to the affordability calculations. Personal name landlords rely more heavily on five year fixed rate calculation due to higher stress rates.

- Loan To Values have been 3% higher for Limited structures than personal name borrowing which has been linked to rental calculations.

Landlords opting for the Limited Company route, or incorporating from their personal name, should consult specialist advisors to fully assess their tax implications for both options. Based on this advice our Mortgage Consultants can assist in finding the most suitable borrowing package. We are here to help you every step of the way just give us a call 01628 564631 or email us info@brooklynsfinancial.co.uk

Your mortgage is secured on your property. Your home may be repossessed if you do not keep up repayments on your mortgage.

The information contained within was correct at the time of publication but is subject to change.

Source: limited-company-report (paragonbank.co.uk)